ICRA reaffirmed rating 'A1+' to commercial paper programme of Rs 5 billion (enhanced from Rs 2.50 billion) of Chambal Fertilisers & Chemicals (CFCL).

ICRA reaffirmed rating 'A1+' to commercial paper programme of Rs 5 billion (enhanced from Rs 2.50 billion) of Chambal Fertilisers & Chemicals (CFCL).

The rating reaffirm factors in the favorable demand prospects of urea in the domestic market with a significant mismatch between supply and demand, the established position of CFCL in the domestic fertilizer industry, being the largest private sector urea manufacturer in India with healthy energy efficiency and capacity utilisation levels, and stable cash generation from the urea operations.

The rating reaffirm factors in the favorable demand prospects of urea in the domestic market with a significant mismatch between supply and demand, the established position of CFCL in the domestic fertilizer industry, being the largest private sector urea manufacturer in India with healthy energy efficiency and capacity utilisation levels, and stable cash generation from the urea operations.

Further, the company has a strong marketing and distribution network to facilitate its fertiliser and trading operations. The increase in fixed cost imbursement for urea for FY15 is also expected to lead to an improvement in profitability for urea going forward, although margins in percentage terms may decline in case domestic gas prices increase as per the recommendation of the Rangarajan Committee. The rating also factors in the high financial flexibility on account of the group strength as well as the standing of the company among the lenders and investors.

The rating, however, considers the vulnerability of profitability of the fertiliser sector to regulatory policies and agro-climatic conditions, and sensitivity of fertiliser cash flows to delay in subsidy receipts from the GoI, which has led to an increase in the borrowings of the company in the recent past. Delays in subsidy receipts are expected to continue in the near-to-medium term on account of the high fiscal deficit of the GoI and under-budgeting of subsidy in the interim budget for 2014-15, which is likely to continue to keep the gearing at elevated levels in the near term.

Further, the profitability of the shipping division of the company continues to be impacted by the unfavourable global shipping sector scenario; the tankers of the company are currently employed at low spot rates, leading to low returns for the division. The shipping division will have to depend to some extent on cash flows generated from the fertiliser operations in the near-to-medium term for the debt servicing, as the annual repayments are substantial relative to the cash generated by the division given the unfavourable shipping sector scenario.

ICRA will review the ratings once the company finalises these investments and there is more clarity on the funding structure for these projects.

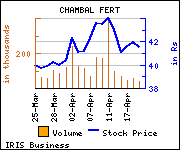

Shares of the company gained Rs 1, or 2.41%, to trade at Rs 42.50. The total volume of shares traded was 71,827 at the BSE (1.32 p.m., Wednesday).